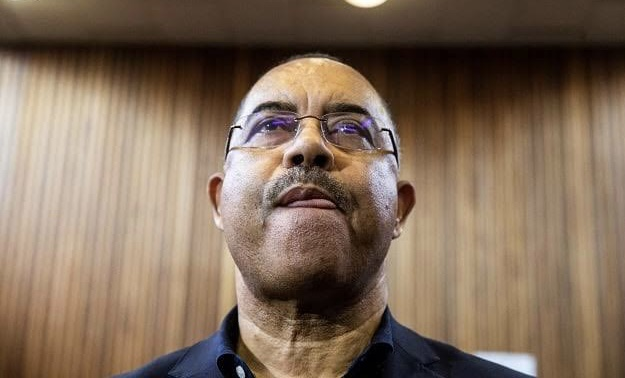

A federal jury in Brooklyn, New York, convicted the former finance minister of Mozambique for his role in a $2 billion fraud, bribery, and money laundering scheme that victimised investors in the United States and elsewhere.

According to court documents and evidence presented at trial, Manuel Chang, 68, of Mozambique, received $7 million in bribes in exchange for signing guarantees on behalf of the Republic of Mozambique to secure funding for three loans for maritime projects. As part of the scheme, Chang and his co-conspirators falsely told banks and investors that the loan proceeds would be used for the projects and not to pay bribes to government officials. In fact, however, Chang and his co-conspirators diverted more than $200 million of the loan proceeds that were used, among other things, to pay bribes and kickbacks to Chang and others.

“While serving as Finance Minister of Mozambique, Manuel Chang obtained $7 million in bribe payments in exchange for signing guarantees to secure more than $2 billion in loans,” said Principal Deputy Assistant Attorney General Nicole M. Argentieri, head of the Justice Department’s Criminal Division. “Not only did Chang’s abuse of authority betray the trust of the Mozambican people, but his corrupt bargain also caused investors—including U.S. investors—to suffer substantial losses on those loans. Chang’s conviction today demonstrates that the Criminal Division is committed to combatting foreign corruption in violation of U.S. law, no matter where these schemes occur or whom they involve.”

The trial evidence showed that, between approximately 2013 and 2015, Chang, together with his co-conspirators—including executives of Privinvest Group, a United Arab Emirates-based shipbuilding company—ensured that a United Kingdom subsidiary of Credit Suisse AG and another foreign investment bank arranged for more than $2 billion to be extended to companies owned and controlled by the Mozambican government: Proindicus S.A. (Proindicus), Empresa Moçambicana de Atum, S.A. (EMATUM), and Mozambique Asset Management (MAM). The proceeds of the loans were intended to fund three maritime projects for which Privinvest was to provide the equipment and services.

“Today’s verdict is an inspiring victory for justice and the people of Mozambique who were betrayed by the defendant, a corrupt, high-ranking government official whose greed and self-interest sold out one of the poorest countries in the world,” said U.S. Attorney Breon Peace for the Eastern District of New York. “Chang now stands convicted of pocketing millions in bribes to approve projects that ultimately failed, laundering the money, and leaving investors and Mozambique stuck with the bill.”

Chang and his co-conspirators illegally facilitated Privinvest’s diversion of more than $200 million of the loan proceeds to bribes and kickbacks. These funds included more than $150 million that Privinvest used to bribe Chang and other Mozambican government officials to ensure that companies owned and controlled by the Mozambican government entered into the loan arrangements, and that the government of Mozambique guaranteed those loans. The loans were subsequently sold in whole or in part to investors worldwide, including in the United States.

In so doing, the participants defrauded these investors by misrepresenting how the loan proceeds would be used. Ultimately, Proindicus, EMATUM, and MAM each defaulted on their loans and proceeded to miss more than $700 million in loan payments, causing substantial losses to investors.

The jury convicted Chang of one count of conspiracy to commit wire fraud and one count of conspiracy to commit money laundering. He faces a maximum penalty of 20 years in prison on each count. A federal district court judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors.

In October 2021, Credit Suisse AG and CSSEL (together, Credit Suisse) admitted to defrauding U.S. and international investors in the financing of an $850 million loan for the EMATUM project. CSSEL pleaded guilty to conspiracy to commit wire fraud and Credit Suisse AG entered into a deferred prosecution agreement with the Criminal Division’s Fraud Section and Money Laundering and Asset Recovery Section (MLARS), and the U.S. Attorney’s Office for the Eastern District of New York. As a part of the resolution, Credit Suisse paid approximately $475 million in penalties, fines, and disgorgement as part of coordinated resolutions with criminal and civil authorities in the United States and the United Kingdom.

The FBI New York Field Office investigated the case.

Trial Attorney Peter Cooch of the Criminal Division’s Fraud Section, MLARS Trial Attorney Morgan Cohen, and Assistant U.S. Attorneys Hiral D. Mehta, Genny Ngai, and Jonathan Siegel for the Eastern District of New York are prosecuting the case.

The Justice Department’s Office of International Affairs provided substantial assistance. The Justice Department also appreciates the assistance of South African authorities, particularly those in the South African Department of Justice and Constitutional Development, as well as authorities in the United Kingdom, Switzerland, Spain, and Portugal.

MLARS’ Bank Integrity Unit investigates and prosecutes banks and other financial institutions, including their officers, managers, and employees, whose actions threaten the integrity of the individual institution or the wider financial system.

The Fraud Section is responsible for investigating and prosecuting Foreign Corrupt Practices Act (FCPA) and Foreign Extortion Prevention Act (FEPA) matters. Additional information about the Justice Department’s FCPA enforcement efforts can be found at www.justice.gov/criminal/fraud/fcpa.