Evidence in the case involving Patrick Majekodunmi Benjamin and his wife, Ubrure Jite, indicates that Fidelity Bank falsely claimed Remitly, an international money transfer operator, had instructed the bank not to disburse the funds to the intended recipient.

However, contrary to this claim, Remitly had been reminding the sender to inform the receiver to pick up the funds at Fidelity Bank.

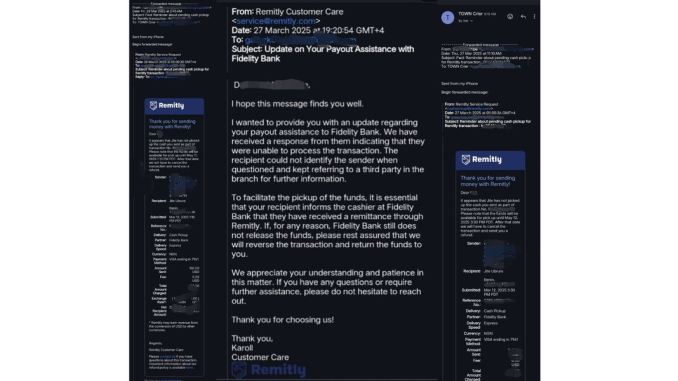

An email statement from Remitly to the sender, obtained by SaharaReporters, clearly shows that Remitly was aware of the sender’s name and address—contradicting Fidelity Bank’s assertion.

The document also reveals that Remitly repeatedly reminded the sender that the receiver, Ubrure Jite, had not yet collected the cash sent as part of the transaction.

Meanwhile, SaharaReporters previously reported that Patrick accused Fidelity Bank of unlawfully withholding his wife’s funds and allegedly insinuating bribery before releasing them.

Patrick, speaking on behalf of his wife, Ubrure Jite, stated that an Operations Manager at the bank, identified as Nosa, demanded a bribe despite their full compliance with all required documentation.

Additionally, reminder emails sent by Remitly to the sender on March 27 and 28, 2025, further confirm that the sender was known to the international money transfer operator.

Remitly statement read, “Thank you for sending money with Remitly! It appears that Jite has not picked up the cash you sent as part of transaction. Please note that the funds will be available for pick up until May 11, 2025 1:10 PM PDT. After that date, we will have to cancel the transaction and send you a refund.”

This contradicts Fidelity Bank’s claim to SaharaReporters that Remitly instructed them not to disburse the funds to the receiver.

A statement signed by Customer Care representative Karoll, obtained by SaharaReporters, proves otherwise.

The statement reveals that it was Fidelity Bank that informed Remitly that they were unable to process the transaction because the recipient could not identify the sender when questioned and instead referred to a third party at the branch for further information.

The statement read, “I wanted to provide you with an update regarding your payout assistance to Fidelity Bank. We have received a response from them indicating that they were unable to process the transaction. The recipient could not identify the sender when questioned and kept referring to a third party in the branch for further information.

“To facilitate the pickup of the funds, it is essential that your recipient informs the cashier at Fidelity Bank that they have received a remittance through Remitly. If, for any reason, Fidelity Bank still does not release the funds, please rest assured that we will reverse the transaction and return the funds to you.”

“We appreciate your understanding and patience in this matter. If you have any questions or require further assistance, please do not hesitate to reach out,” Karoll added.

Meanwhile, Divisional Head of Brand and Communications, Meksley Nwagboh, told SaharaReporters on Tuesday night that Remitly instructed them not to disburse the funds to the receiver.

“I’m calling regarding a story that accused one of our staff members of refusing to pay a customer and allegedly demanding a bribe—without any evidence whatsoever to support this claim. That staff member is a human being, just like you and me.

“Imagine his child reading such an allegation,” Meksley stated.

He said, “I sent a screenshot of a response from Remitly stating: ‘Please don’t pay this money. This money is not real. The customer cannot verify the sender.’ This message came from Remitly, the IMTO that processed the transaction.

“Now, despite Remitly’s directive and our sharing of this evidence, I still see a story online stating that we refused to pay a customer and that, in addition, our staff member demanded a bribe—without any proof. That’s why I’m calling to hear your side and understand how this story was put together.”

Meksley told SaharaReporters that it was Remitly that flagged the transaction, yet Nosa is being accused.

“Anyone can walk up to you, record a video, and make an accusation. But that doesn’t prove someone asked for a bribe or received one.

“The customer claims he paid Nosa a bribe to receive the first transaction. If so, let him provide evidence—a bank transfer, a record of payment—anything. If such evidence exists, I will personally sack Nosa immediately.

“Verifying a customer is not a crime. The operations manager can identify a customer, but Nosa’s job is in operations, not sales. If someone from sales instructs Nosa to make a payment, he is not obligated to comply unless proper verification is conducted,” he said.

Meanwhile, SaharaReporters waited for over 24 hours for a response before Fidelity Bank sent a screenshot showing that Remitly had instructed them not to disburse the funds to the recipient.

Meksley said, “Now, let’s look at the situation objectively. The customer can claim anything, but you, as a journalist, are the umpire in this matter. You have reached out, and we are providing context.

“Here’s the truth: The customer first came and was paid for one transaction. But the next day, he attempted to collect a transaction that had been split into seven parts. That is fraud.”

He explained that in IMTO transactions, “funds should not be split in such a manner—it indicates an attempt to evade regulatory thresholds. That’s why Nosa was concerned and refused to proceed with the payment”.

“To ensure due diligence, Nosa called the IMTO directly. They responded, in writing, that the money should not be paid. We followed that directive.

“The customer still has the option to instruct the sender to recall the funds through Fidelity. That is within his rights. But we cannot be bullied into facilitating a fraudulent transaction,” he said.

“You also asked why I cannot provide a written response. As a banker, I have a professional obligation not to divulge customer details. You will notice that throughout this conversation, I have not mentioned the customer’s name or account number. Just as a lawyer cannot disclose client information and a doctor cannot break patient confidentiality, I cannot violate banking regulations,” he said.

Meksley stated, “Yet, despite this, your headline reads: ‘Fidelity Bank Accused of Withholding Funds and Demanding Bribe.’ But what if I report this case to the police?

“If the police investigate and find that the person you are protecting is actually a fraudster, what happens next?

“You may not realise it, but your report is misleading. You mentioned the IMTO’s directive deep within the article, but it was not reflected in the headline. The headline should state: ‘Customer Alleges Non-Payment and Bribery Demand, But IMTO Ordered Bank Not to Pay Due to Verification Issues.”

“That would be the full truth. Tomorrow, I will escalate this to the authorities. I will report that the customer attempted to split the transaction—a clear sign of fraud. I will report that when questioned, he could not verify his relationship with the sender. That is another red flag. I will report that we contacted the IMTO, and they instructed us not to pay.

“Your story only states that the customer was frustrated. It does not mention that the IMTO flagged the transaction. It does not mention that there was no evidence of bribery.

“You placed a face to this accusation—Nosa’s. To you, he is just a name in your report. But to me, he is a father, a husband, and a professional. Tomorrow, if he applies for a position and his name is searched online, all that will appear is an unverified bribery allegation.”

“That is why I am taking the time to explain this to you. Today, it is Nosa. Tomorrow, it could be me or you. This is not about protecting a bank. It is about protecting a human being from an unfair and incomplete narrative,” Meksley added.

Background

Patrick told SaharaReporters that on Friday, March 14, he and Jite visited the Fidelity Bank branch at the University of Benin (UNIBEN) to receive funds sent to her via Remitly.

At the counter, bank officials informed them that there was a discrepancy in her middle name and that the sender needed to correct it. Once the correction was made and confirmed by the bank, they expected to receive the funds without further delay.

“After the correction, Nosa, the Operations Manager, only gave me a part of the funds and instructed me to return on Monday, March 17, to collect the remaining balance,” Patrick said.

However, when he returned on March 17, Nosa refused to release the remaining money.

“I returned as instructed, but Nosa flatly refused to release the rest of the money. When I pressed for a reason, he said he wouldn’t release the money because the sender’s name was foreign, and he wasn’t comfortable with the transfers. That response wasn’t legitimate to me,” he said.

Sensing that the issue was no longer an ordinary banking delay, Patrick escalated the matter to Fidelity Bank’s headquarters.

“They asked for reference numbers of the transactions and other information like National Identification Number (NIN), which we provided. Their response? They referred us back to the same UNIBEN branch, effectively putting the decision back in Nosa’s hands.”

Patrick said that upon their return to the UNIBEN branch, Nosa claimed he had received fresh instructions not to release the funds.

However, he reportedly failed to provide any formal documentation to support this claim, further raising suspicions of foul play.

He said, “By this time, we had already submitted all necessary documents, including the required Bank Verification Number (BVN), NIN, home address, phone number, email address, telex copies, reference numbers of the transactions, the name of the sender, relationship with the sender, and the purpose of the funds.

“There was no petition against the account, no complaint from the sender, and no regulatory restriction on the funds. Yet, the money was still withheld,” he said.

Patrick explained that on March 20, a regional staff member from Fidelity Bank intervened by forwarding his written complaint to the UNIBEN Branch Manager (BM).

The BM reviewed the case and requested that he come to the bank in person to resolve the matter.

On March 21, Patrick met with the BM, who listened to his complaints and questioned Nosa about the issue.

“After hearing both sides, the BM faulted Nosa and instructed him to apologise to me. Shockingly, Nosa refused to apologise outright, openly disrespecting his superior,” he said.

He said rather than enforcing her authority, the BM ignored his insubordination and simply instructed him to release the funds.

However, before the process could be completed, she had to leave for a meeting at the University of Benin Teaching Hospital (UBTH).

Patrick alleged that once the BM left, Nosa resumed his old tactics.

“Once again, it was just Nosa and me in the office. He reverted to claiming he had emailed Fidelity’s Remittance Unit and that they had instructed him not to release the money.”

That same day, Patrick said Nosa made unsettling remarks implying that a bribe was expected before the funds would be released.

“He said, ‘Do the needful.’ ‘You know how these things are done.’ ‘The sender’s name is a foreign name.’ This made it clear that the refusal to release my funds was not due to any procedural issue but rather a deliberate act of extortion,” he said.

He said even after receiving direct instruction from the bank’s management, Nosa refused to comply, raising questions about the bank’s management’s accountability.

“At this point, the only logical conclusion is that this was never about banking regulations—it was about extortion,” Patrick said.